It’s no secret that the SF Bay Area has long been the heart of technology innovation in the U.S.,

but when it comes to AI, its dominance is even more pronounced. As someone who is deeply involved in the tech scene,

I’ve had a front-row seat to witness just how impactful this region is in shaping the future of artificial intelligence.

And when I saw the latest data on the top U.S. cities with the most AI employees, it only reinforced my belief that

the Bay Area isn’t going anywhere anytime soon.

SF Bay Area: A Class of Its Own

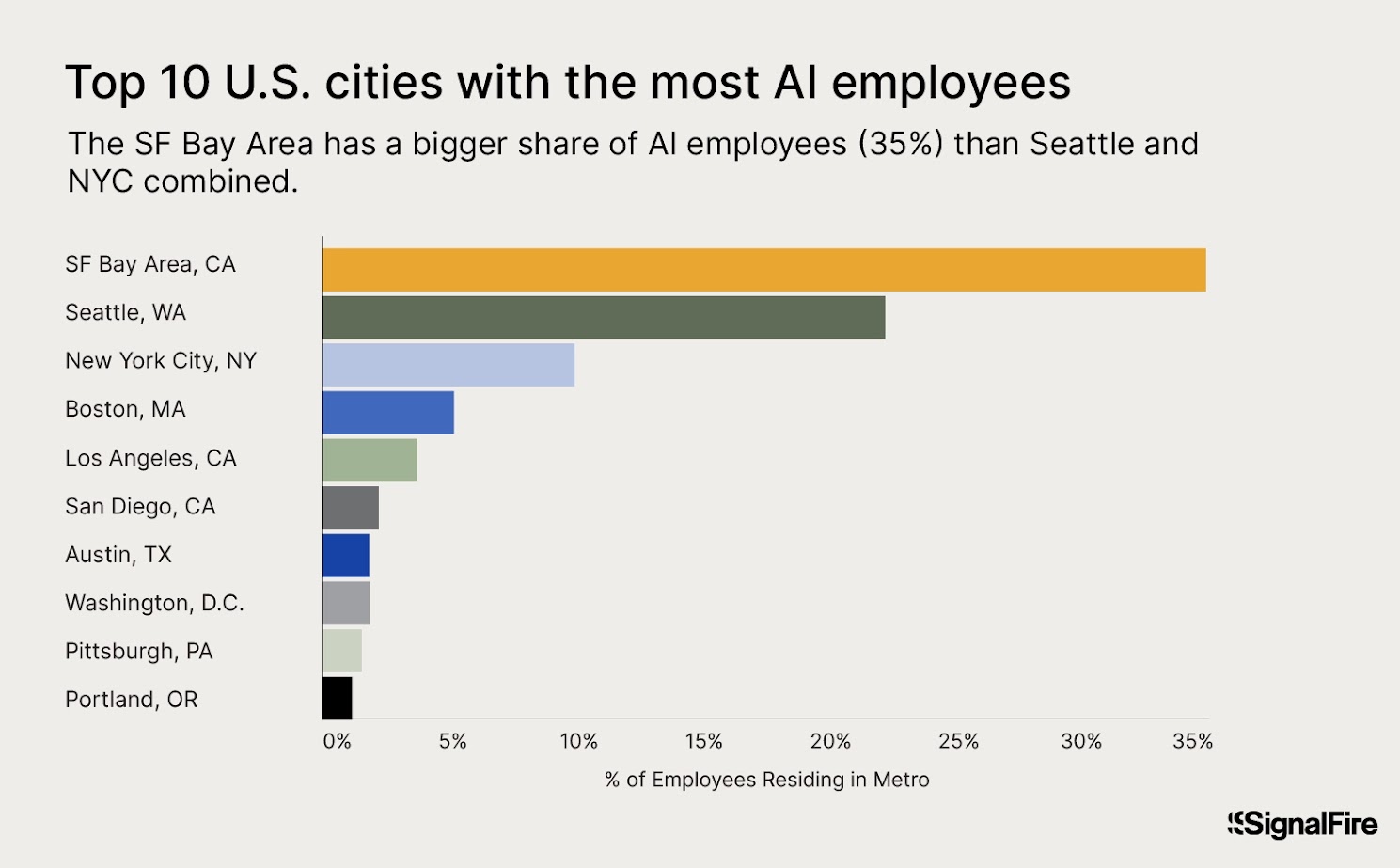

The numbers don’t lie: 35% of all AI employees in the U.S. are concentrated in the SF Bay Area.

To put that in perspective, that’s more than the combined AI workforce of Seattle and New York City, the next two cities

on the list. It’s not just tech buzz or anecdotal success stories that place San Francisco at the top; it’s cold, hard data

that reflects its continued relevance.

The AI Gold Rush

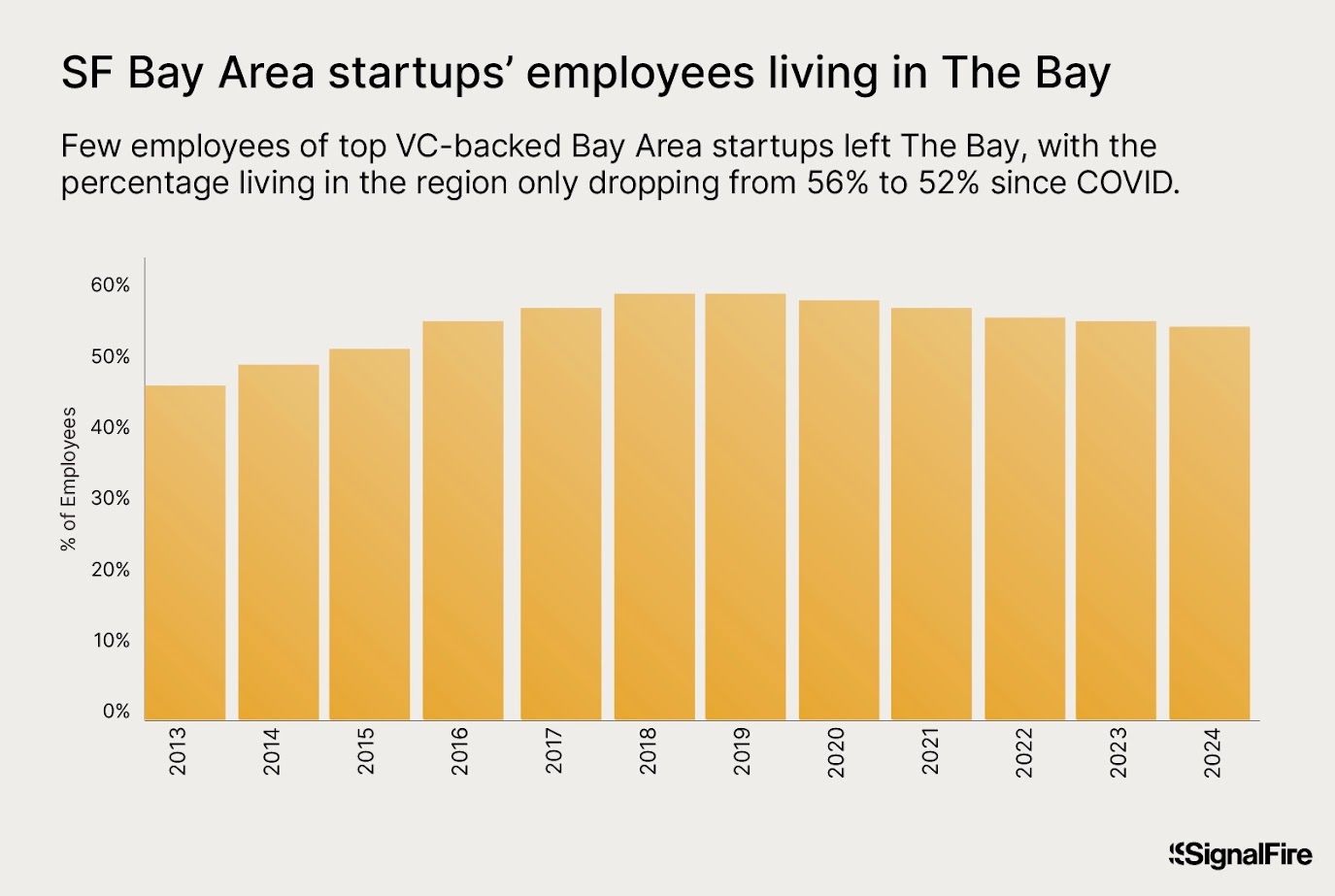

In recent years, the rise of AI has been nothing short of explosive, and nowhere has this been more

apparent than in San Francisco. The region has seen an AI boom, attracting a surge of startups, engineers, and funding.

San Francisco is home to 38% of all VC-backed Seed and Series A rounds in AI companies, more than any other city.

This influx of investment has fueled the area’s growth, making it a hotspot for anyone serious about AI innovation.

The Talent Magnet

One of the reasons the Bay Area continues to thrive in the AI sector is its ability to attract top

talent. With nearly half of all big tech engineers and more than a quarter of startup engineers calling the SF Bay Area

home, it’s clear that the region remains a magnet for tech professionals. This talent pool is further strengthened by

the presence of prestigious institutions like Stanford and Berkeley, which consistently produce some of the best minds

in AI and machine learning.

Final Thoughts

Looking forward, I don’t see this trend slowing down. The Bay Area continues to host some of the most

significant AI conferences and community events, creating an environment where innovators can thrive. The data shows

that while other cities are catching up in tech headcount, the SF Bay Area’s lead is too substantial to be overtaken

anytime soon.

Read the article: “The Surprising Return of the SF Bay Area: Why I’m Back and Why You Should Be Too”