Introduction: The Bubble Bursts

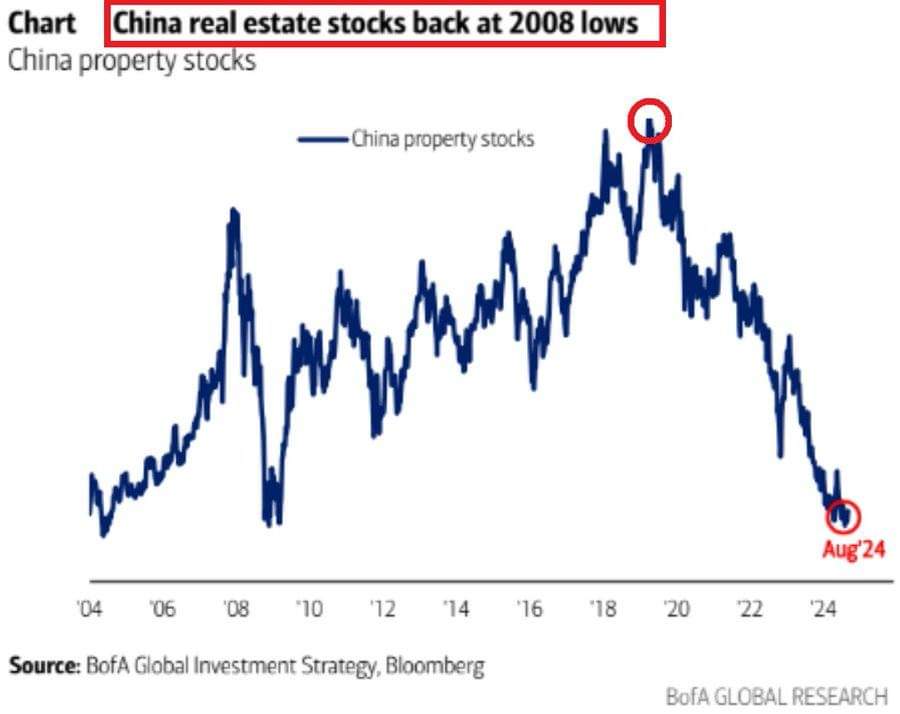

It’s one of the most dramatic economic downfalls we’ve seen in recent history. China’s real estate market, once hailed as an unstoppable powerhouse, is now at its lowest point in nearly 20 years. Just four years ago, property stocks in China were soaring, but today, they have dropped by more than 90%. Major developers have seen their stock values plummet, leaving investors shocked and the market in ruins.

A False Miracle?

China’s real estate boom was often referred to as a “miracle,” with cities rapidly expanding and housing projects appearing at an astonishing rate. But in hindsight, it seems clear that this boom was artificially inflated. The rapid construction and aggressive expansion were built on shaky foundations. The “economic miracle” quickly turned into a nightmare as reality set in—too many developments, not enough buyers, and a market that was unsustainable.

A 20-Year Low

As of August 2024, China’s property stocks have fallen back to the same levels they hit during the 2008 financial crisis. It’s shocking to see that after two decades of aggressive growth, the market has come full circle, only to crash back down. Developers who were once the pride of China’s booming economy now find their stocks trading at junk status, and there are no signs of recovery on the horizon.

Is There Any Hope for Recovery?

For now, it looks like the days of China’s real estate dominance are behind us. The lack of government intervention and continuing economic challenges suggest that this downturn could last for quite some time. With such a steep decline in property stocks and no clear path to recovery, it raises an important question: Was China’s real estate boom a house of cards all along?

Conclusion: Lessons to Be Learned

This crash is a sobering reminder of the risks involved in artificially inflated markets. It shows us the importance of sustainability in economic growth and the dangers of unchecked expansion. As the world watches this crisis unfold, one thing is clear—China’s real estate market will never be the same.

Read the article: “The Alarming Drop in Chinese Startups”

Leave a Reply

You must be logged in to post a comment.